Great learning, profitable trading

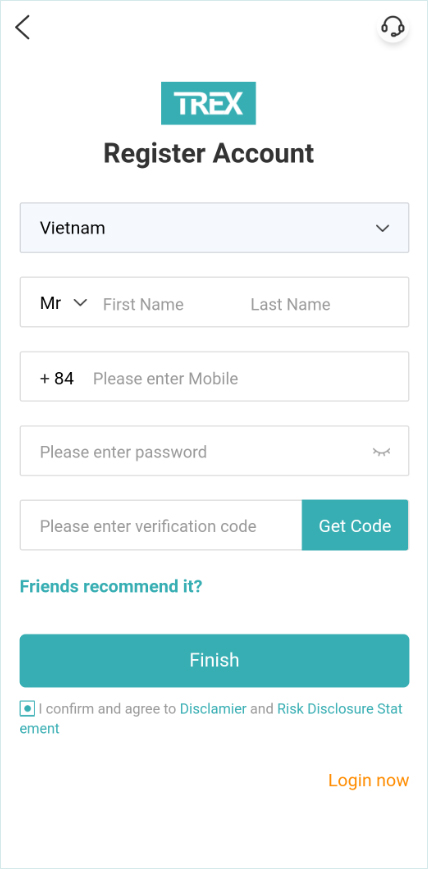

You need to fill in real name information to register an account, if not you will not allow to deposit or withdraw. The registration process are as follows:

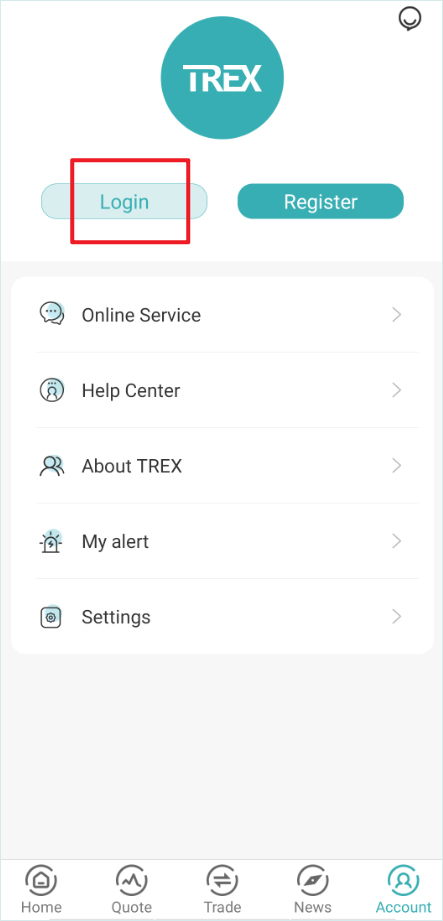

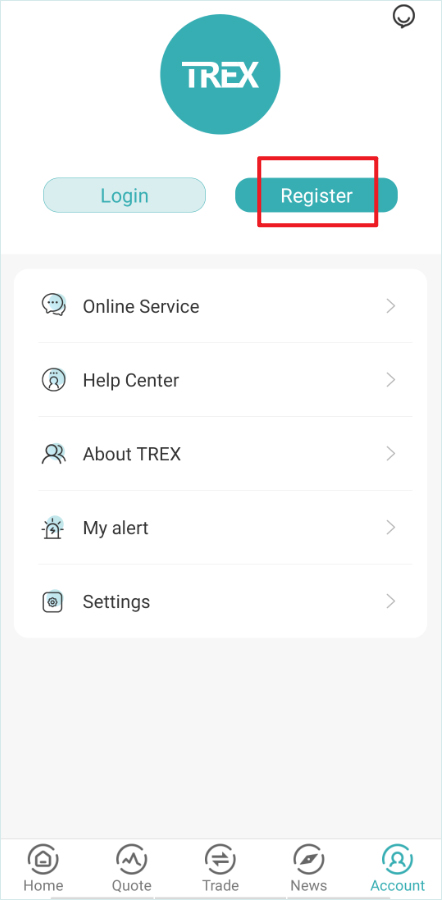

First: Open APP TrexGlobal and go to “Account”, click “Register”.

Second: Fill in the “Name” and “Mobile phone” number, set up “Password”, and then click “Get Code” and enter the code received, click “Confirm” to finish the registration process. You will get an real account and a demo account.

If your friend have recommended you, you can click “ Friends recommend it?” and enter the your friend’s phone number.

When registered successfully, there is a mini account by default. The different account types need different minimum deposit amount to activate, and the spread is different either. Client can upgrade his account types according to his deposited amount and traded volume.

What is the activating account?

When an account is registered, but it have been deposited ever, those accounts will be called account have been activated. Only initial deposit meet the conditions for different account types can activate account. Whenever you registered, if your account have been activated, you can still enjoy the new client activity.

How to activate accounts?

When client registered successfully, his account will meet with an account type( At usual, the account type is Mini.) Different account types corresponding with different depositing amounts to activate. Client need to deposit meet the minimum depositing amounts of his account type to activate account.

Different account types corresponding with different minimum depositing amounts:

| Account types | Minimum depositing amounts |

|---|---|

| Mini | 20USD |

| Standard | 200USD |

| Platinum | 5000USD |

When finished the activated process, client can enjoy the new clients activity and get $5000 bonus at most !

TREX GLOBAL platform don’t support register many accounts, a mobile phone number and a ID card can register an account only.

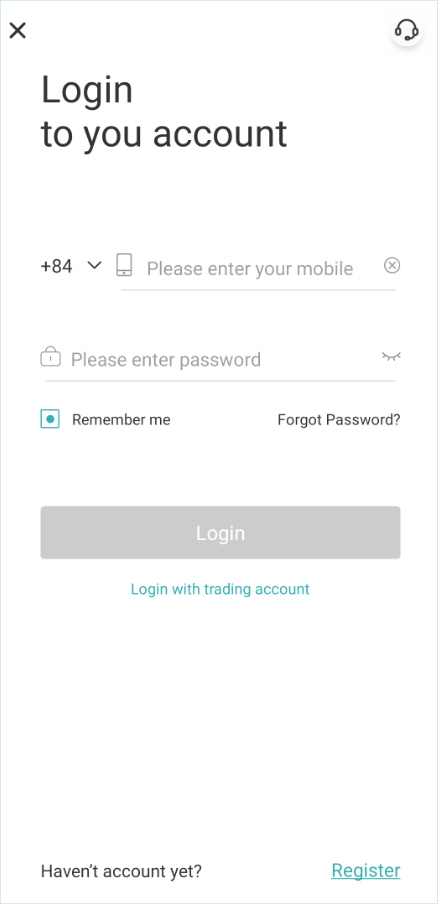

Client can go to the login page and click “Forgot Password?” and then reset password with your registered phone number.

Client need to open TrexGlobal APP, on the “Home” or the “Account” interface click “Login”, and then login with your mobile phone number and password, or switch to login with trading account, enter the account and password to login.